India remains a net gainer from the slump in international commodities, even as exports take a knock

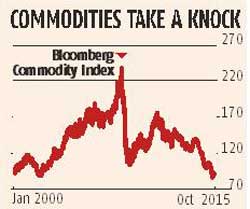

A fall in global commodities prices and slowdown in China have changed growth equations, capital flows and foreign trade globally. India is no exception.

India will be a net gainer, even as lower commodity prices have shrunk exports. It is also likely to attract a greater pie of the shrinking global capital flows.

Aditya Narain, equity strategist, Citigroup Global Markets, says, "India looks to be a net gainer in the current commodity rout. The fall in trade deficit and a corresponding decline in fuel subsidy collectively provides a fiscal cushion and a flexibility for monetary policy. It hits metal producers and its relative effect seems to be percolating to the banking system to that extent - the overall gains outweigh cost."

Retail inflation has come down. In August, it fell to 3.7 per cent and rose marginally to 4.4 per cent in September, largely due to higher prices of pulses, but remains comfortable.

Lower inflation provided room to the Reserve Bank of India, which cut its policy rate by 50 basis points and there was a fresh inflow in the debt market.

On the downside, foreign portfolio investors have sold Indian equities this year in line with a global risk aversion towards emerging market (EM) assets. This has put some pressure on the rupee but it has fared better than its EM peers.

On the downside, foreign portfolio investors have sold Indian equities this year in line with a global risk aversion towards emerging market (EM) assets. This has put some pressure on the rupee but it has fared better than its EM peers.

"The overall foreign investment pie has shrunk but within that, India is getting a bigger share due to its relatively better performance. A relatively stable Indian currency is also attracting lots of fixed income money in Indian debt," adds Narain.

The benefits of lower commodity prices could start reflecting in the stock markets as well. Outflows have stopped and the analysts have turned bullish.

A fall in global commodities prices and slowdown in China have changed growth equations, capital flows and foreign trade globally. India is no exception.

In the first half of FY16, the average price of Brent crude oil was down 47 per cent year-on-year (Y-o-Y) and steel lost 30 per cent. India's merchandise exports in FY15 are likely to be the lowest in the past five years. Export of agri commodities, including basmati rice and buffalo meat, were also down in the first five months of FY16. A sharp fall in export of gems & jewellery, cotton and apparel, and steel was either due to unviable prices or lower demand.

Adds Narain, "The worst for the corporate sector and, hence, the markets is over. Corporate earnings could start showing improvements as early as the next quarter. We see eight per cent earnings growth in the current financial year and 16-17 per cent in FY17."

Falling exports seem to be the only dampener and one that will take time to correct. Asia, including oil-producing West Asia, buy nearly half our goods exports. West Asia has been hit by a slump in crude oil prices. The Trans-Pacific Partnership, a trade agreement signed by Southeast Asian countries and involving 12 countries and including the US, may hit exports. "India's exports may be hit due to the treaty, as there will be a significant diversion of trade, as well as foreign investments from Indian markets. In FY15, a quarter of Indian merchandise exports worth $75 billion went to TPP member-countries," says Nirav Sheth, analyst, Edelweiss Securities.

(BS)

Comments